Overseas entrants drive student accommodation design

International entrants make up a significant proportion of UK university students and as such they are helping to inform design best practice for the purpose-built student accommodation sector

With the UK purpose-built student accommodation (PBSA) market heavily reliant on international entrants, The Property Marketing Strategists (TPMS) has looked into what they want from a living space – and it isn’t the traditional studio!

TPMS undertook research into international students’ views on accommodation and this is likely to help inform design strategies moving forward.

The survey found that, like domestic students, affordability is on the radar, with 75% saying student current accommodation is too expensive.

And there are many influences on cost.

Like all development areas, the planning crisis has made it harder to build, aided by rising cost of materials and higher cost of borrowing.

Yet, despite this, there is a way to drive down costs with creative thinking.

“PBSA is a numbers game”, said Sarah Canning, co-founder of TPMS.

“The sector has been booming, but demand outstrips supply.

“As competition intensifies in the sector, diversity of offer is what is required – and a tool to do this is to simply offer a range of different options – yes, studios, but also 4-5 bedroom apartments enabling students to create stronger community bonds and enabling opportunities to share amenities too.

“This also creates a more-sustainable product that can be repurposed if required in future.”

Across the UK, 45% of PBSA buildings have studios, compared to only 14% of buildings that have 4-6 bed clusters (source: StudentCrowd).

“We need to banish the studio demand myth,” said Canning.

“International students largely do not want to live alone – in fact our research shows just 12% reported to.

“Over 50% want to live with 3-4 other people, they don’t mind sharing kitchens and breakout spaces – but there is some reluctance on sharing bathrooms, which could be negated if only sharing with three other people.

“What really surprised me, though, is the fact that a third are willing to share a bedroom, with this rising to 45% among Indian students, which are one of the fasting-growing student populations in the UK.

“What this tells me is that we really need to dismantle what we think we know about international students, and listen.”

The enthusiasm for sharing bathrooms is notably lower.

International students are reluctant to do so, regardless of financial concerns, with only 21% of international students expressing agreement.

African students are particularly opposed to sharing bathrooms, with less than 10% considering it, while Indian students surpass the average, with 31% willing to share.

Other insights include:

- 61% of parents/guardians are paying for university accommodation and just 12% are using a maintenance or government loan

- International students show a strong inclination towards stability, with 22% favouring a 12-month lease. This desire for a longer contract is emphasised by the findings that nearly a third (32%) of international students from Asia prefer accommodation contracts for the full length of their degree. This contrasts with the 19% figure among European students, highlighting regional variations in accommodation preferences

- 77% of international students want all utility bills included in their rent payments, even if this results in paying a higher overall rent

- 57% would like a washing machine in their apartment

Here, we look more closely at the findings of the study and how they will inform PBSA design in the UK moving forward.

Design and layout

Delving into the intricate details of design and layout, the data sheds light on the choices and rationales behind why students select certain apartment types and what international students are prepared to pay for.

When asked to consider the four different layouts shown in the graphic above, the most-popular option was D, capturing nearly half of the international respondents’ preferences, especially among those outside of Europe.

Private bathrooms, more-efficient use of space, co-working areas, connected-yet-isolated rooms, sizeable living areas, and a homely atmosphere made it the most-popular.

The next favourite was option C due to its provision of private ensuite bathrooms, separation of bedrooms from communal areas to mitigate noise, inclusion of private study areas within individual rooms, and an even balance of private and shared areas.

The report advises: “The absence of corridors fosters a sense of home, akin to a residential flat – welcoming and open.

“For some, the proximity of communal areas to bedrooms in layout D may raise concerns about noise. Additionally, those inclined towards private study spaces might find the layout C more suitable, as it offers a good balance between private and communal areas.”

Study spaces

Focus group discussions underscore the significance of mental health, with students expressing concerns about having to work in their room.

When questioned, a majority said they liked to study at home, but not necessarily in the bedroom.

So, the report suggests the answer lies with the response made by international students, who said they would be willing to pay

more for a dedicated communal study area, with 27% ranking it as a priority.

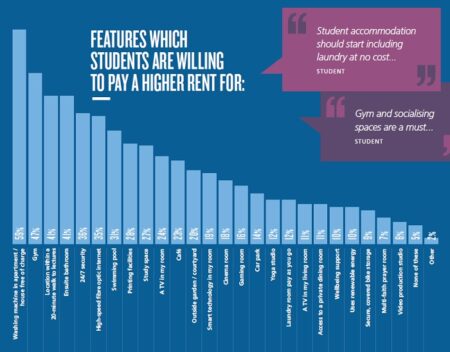

Pricing Vs Amenities

Developers must consider variations in perception when assessing the affordability and value of student accommodation.

The top five features students are willing to pay a higher price for are:

- A gym (45%)

- High-speed fibre optic internet (34%)

- Free-of-charge washing machine (57%)

- 24/7 security (33%)

- Accommodation located less than 20 minutes walk from lecture halls (41%)

Among international students, an ensuite bathroom is important, with 41% willing to pay a higher rent for this amenity.

And there a stark differences for male and female students and from the global community, with students from Africa prioritising the gym over a washing machine, while those from India exhibit less enthusiasm for having a swimming pool.

“The interplay between prices and amenities is something that, for students, is a pivotal aspect that shapes many of their choices and one that developers should closely understand”, says the report.

Catering

The data shows that a significant majority of international students express a preference for self-catering accommodation.

However, 23% still opt for catered options, with 13% remaining unsure.

Interestingly, international students are 10% more inclined towards

catered accommodation compared to their British counterparts. Additionally, there is a gender difference, as females are approximately 5% more likely to favour self-catered options.

And Asian students appear to prefer catered accommodation, whereas African students exhibit a strong inclination towards self-catering options. European and ‘rest of the world’ students fall in between the two.

The report states: “It is worth providers considering a hybrid model which offers flexibility.

“At the moment the market generally offers one version that doesn’t allow you to change your mind halfway through the year.”

Sharing spaces

When it comes to the dynamics of shared accommodation among international students, preferences reflect a blend of cultural norms, financial considerations, and personal inclinations.

The report states: “Contrary to popular opinion that international

students prefer studio living, the data gathered in this survey actually illustrates a meagre 12% would choose to live alone.

“Often the booking cycle leaves those who book late with a lack of choice – and studios are often the product that is slowest to be booked (in some markets).

“This fits into the idea that sharing units of five is the

magic number, creating a sense of familiarity akin to family or close friendships.”

It adds that bathrooms are a key selling point for accommodation choice.

“Sharing a room to cut costs is gaining traction, especially among

international students”, it states.

“With this option prevalent in mainland Europe and America, the key lies in perfecting the allocation model and layout.

“This data shows the importance of product diversity. Sharing a bathroom en masse does not work, so a small number of rooms with a shared bathroom provides more-affordable options for those that are on a limited budget.”

Social events and community

Students arriving from abroad with a heightened desire to forge connections, have more of a need to engage in events organised by their student accommodation providers, according to the data.

Flexible spaces offering events such as film nights, cooking classes, and sports tournaments rank among the most-popular choices.

Gender and nationality also play a role, with females showing more interest in activities like yoga and cooking classes, while maoles lean towards sports teams and tournaments.

And African students display the highest levels of interest in hosted events.

The report advises: “The data reflects a desire for events that focus on self improvement and personal development, highlighting the need for flexible spaces that can accommodate a wide range of activities.”

Sustainable living

International students prioritise six key sustainability features when electing their accommodation to embrace and eco-friendly lifestyle:

- Access to public transport (76%)

- Good insulation (60%)

- Smart technology (44%)

- Organised recycling facilities (37%)

- Environmentally-friendly flatmates (61%)

- Solar panels (21%)bo

“Students are demonstrating a growing interest in sustainable living

and this is impacting their choice of accommodation,” the report states.

“Understanding their preferences and priorities in this regard is crucial for student accommodation providers striving to create environments that align with the values and expectations of their diverse resident population.”

In conclusion

The report concludes: “While students have booked student accommodation in their droves, with most global markets flourishing, we urge you to look to the future and look at whether

your portfolio can withstand a new type of customer?

“The evidence in this research points to a discerning cohort who, while they are living in their student accommodation across the world right now, are they thriving? Are they happy? And are their needs being met?

“It is within our gift as a sector to work together to understand local nuances, to segment the audience, and to forecast for the future.”