Affordability issues impact on student accommodation market

Continuing student bed vacancies, despite accommodation shortage, suggests affordability issues, according to a Cushman & Wakefield report

The economic viability of building student accommodation is under scrutiny in Cushman & Wakefield’s latest UK Student Accommodation Report, which highlights a disconnect between pockets of underoccupancy against growing student demand.

Despite the national student-to-bed ratio (SBR) standing at over two students for every available purpose-built student accommodation (PBSA) bed, pockets of underoccupancy are evident as the market faces falling international postgraduate demand and affordability issues.

The paper highlights that, in Sheffield, the demand pool is projected to have fallen by 17.3% between 2022/23 and 2024/25, resulting in a student to bed ratio of 1.21:1, down from 1.46:1.

And Cushman & Wakefield said such a ratio is ‘unprecedented’ in a major market and has resulted in the largest decrease in PBSA rents in the UK this year, at -5.5%.

The report also notes the cyclical nature of large PBSA markets, which have trended towards recovery from dips over time.

The juxtaposition of overall structural undersupply against underoccupancy points to affordability constraints impacting student living decisions.

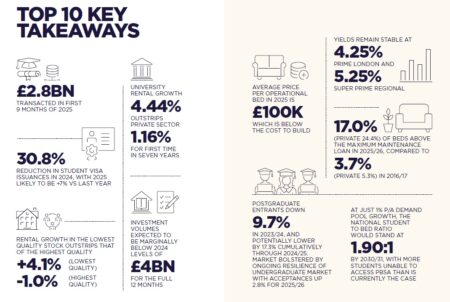

In the latest academic year, analysis shows university rental growth outpaced the private sector for the first time in seven years, growing by 4.44% – nearly four times greater than the private sector’s rental growth at 1.16%.

And, for only the third time in 12 years, the lowest-quality accommodation delivered rental increases above those of the highest-quality beds.

David Feeney, partner in Cushman & Wakefield’s UK student accommodation team, said: “Unfilled beds is a concern.

“We project that postgraduate numbers have fallen by over 17% over the last two years, and while international student numbers are likely to stabilise after these initial visa shockwaves, we’re also seeing a rise in commuting students or those living at home because the cost of accommodation is simply too high for many.

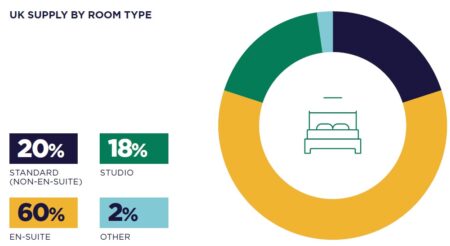

“Meanwhile, stock at the same quality levels is competing for the PBSA student body, where ensuite cluster accommodation will lose out if the price point hits above affordability limits.

“Overall, in the post-COVID world, many students are balancing lifestyle and value for money when considering accommodation location.”

Cushman & Wakefield’s report indicates that the most-poorly-occupied ensuite developments this year were priced at 110% of the maximum Maintenance Loan, compared with 95% for the best-occupied schemes.

What’s more, average annual rents now take up more of the Student Maintenance Loan than ever, with a record 23% of beds in England (including London) costing above the maximum loan.

While in some major markets, over two thirds of all students with a requirement for a bed can secure one under the maximum Maintenance Loan rate, in other markets this figure falls to as low as 12%.

And, for providers, the price of rents set is also resultative of wider viability issues in the residential sector, construction constraints brought on by the Building Safety Act, and ongoing inflationary pressures.

Developers are forced to charge higher rents in line with higher building costs.

As a result of these smaller margins, less than 20% of the PBSA pipeline is currently under construction, with viability of development requiring a blended rent of around £265 per week.

While markets don’t like uncertainty, investors still see huge opportunity in a number of undersupplied locations across the pricing spectrum, provided value for money and a good student experience is delivered

Cushman & Wakefield highlights an outlook of subdued growth as a result – although higher than post-COVID levels – compared with previous averages seen over the last decade.

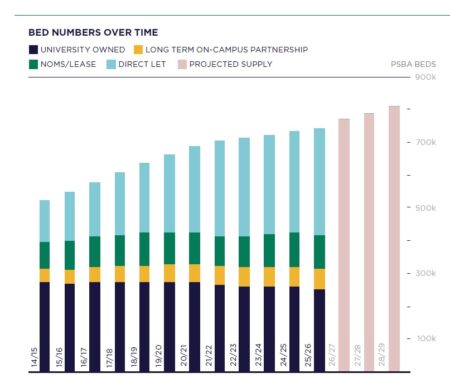

Furthermore, just 18,200 new beds entered the market this year, a net increase of 10,000, yet still far below pre-pandemic levels.

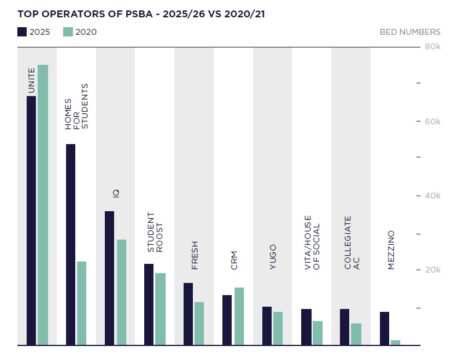

Over the last five years, an accumulative total of 88,000 beds has been delivered nationally, versus the 158,000 in the previous five years, which is a fall in delivery annually from an average of 31,600 new beds a year to 17,600, according to the report.

Investor opportunity

Overall, problems of structural undersupply continue to underpin a significant proportion of the market, keeping the PBSA investment market outlook buoyant, despite macroeconomic factors.

In terms of market trajectory, if the next five years sees demand for accommodation grow at 1% per year, which is less than half the rate seen over the last decade, the number of students requiring, but unable to secure, a bed in PBSA would still stand at close to 750,000 (a student to bed ratio of 1.90:1).

Feeney, said: “While markets don’t like uncertainty, investors still see huge opportunity in a number of undersupplied locations across the pricing spectrum, provided value for money and a good student experience is delivered.

“‘Know your market’ is a truer sentiment now than ever before.

“Overall, the report signals that the Purpose Built Student Accommodation sector remains a robust, defensive asset class for investment, supported by strong demand and supply fundamentals.

“Looking forward, even under an extremely-unlikely zero-demand growth scenario, student demand will continue to significantly outstrip supply by 2030.

“Needless to say, the UK is one of the top higher educational destinations, with four institutions in the global top 10.”

Regional markets

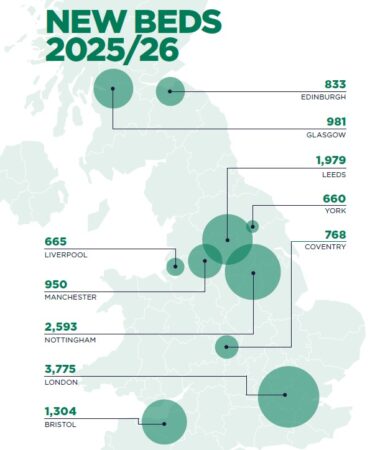

While 27 different markets have seen new beds, the report highlights that just three markets make up nearly half of all new beds (London, Nottingham and Leeds), demonstrating investor focus is limited to major markets where development viability can be delivered.

The last five years has seen the emergence of Nottingham as the second-largest PBSA market in the UK, with a staggering 35% increase in supply.

In 2025/26 it saw 2,593 new student beds delivered, second after London’s 3,775.

Leeds (1,979) and Bristol (1,304) follow as the third and fourth-highest university cities for new accommodation this year.

A number of other major markets have seen no new deliveries.

The report signals that the Purpose Built Student Accommodation sector remains a robust, defensive asset class for investment, supported by strong demand and supply fundamentals

Cushman & Wakefield highlight Leeds as a city of changing market dynamics in a short period of time as a result of policy impacts and demand changes.

And it projects the demand pool fell by 7.2% between 2022/23 and 2024/25 against a 21.3% increase in PBSA.

This year, though, saw the highest annual delivery for new beds in Leeds in five years.

With a further 8,700 beds proposed, and 6,300 already consented in the city, alongside the arrival of Build-to-Rent (BTR) schemes targeting student renters, the Leeds PBSA market risks oversupply, especially with the lack of pricing and quality diversity in terms of rental new supply.

Manchester, while an expensive market in comparison to five years ago, is still performing well due to a net loss in beds over the last five years, with demand remaining high.

Significantly, for the first time since its introduction, London has exceeded the London Plan’s 3,500 beds-per-year target.

Feeney said: “Viability issues and risk aversion mean developers are now focusing on a limited number of ‘premium’ locations.

“The potential for growth and weight of the development pipeline varies significantly from market to market.

“Our analysis shows that student-to-bed ratios (SBR) are set to fall in half of the 14 largest locations over coming years.

“We have moved on from the arms race seen a few years ago of developing the best accommodation with the best amenity spaces, and the fear of not meeting that expectation.

“Today, our data indicates that value for money concerns mean quality, at least in the mid-market, is no longer the determining factor.”