Building a picture of education construction activity

Glenigan’s latest Construction Review paints a dim picture as the education sector continues to face challenges

The education construction sector continues to face challenges, with project starts on site falling by 40% compared to last year, according to a new Glenigan industry report.

The Glenigan Construction Review for March 2024 reflects activity across all key sectors in the three months to February this year.

And it reveals that education work starting on site totalled £1.07bn, unchanged on the previous three months, but significantly down on the same period last year.

Major projects worth £100m or more starting on site totalled £110m, an increase from the preceding quarter when no projects commenced, but 45% down on a year ago.

Underlying education work starting on site worth less than £100m in value also experienced an 18% decline against the preceding three months and was 39% down on a year ago, totalling £964m.

And main contract awards in the sector were up by 1% against the previous three months to total £1bn, 15% lower than the previous year.

Contract awards

While underlying contract awards increased by 11% against the previous three months, this was 15% down on the previous year.

No major projects reached the contract award stage, according to the data, down on the previous three months, but unchanged on last year.

And, totalling £1.2bn, detailed planning approvals – often seen as a sign of future activity – fell by 9% against the preceding three months and were 9% lower than last year.

Like main contract awards, there were no major project approvals, a decrease from both the previous quarter and a year ago.

For type of projects, school project starts totalled £769m during the three-month period and accounted for the largest share across the sector – 72% – despite a 23% decline on the previous year.

University activity also declined, falling 60% on last year to total £153m and accounting for 14% of the total value of work; while college project starts slipped back 40% against the previous year, worth £126m.

Region by region

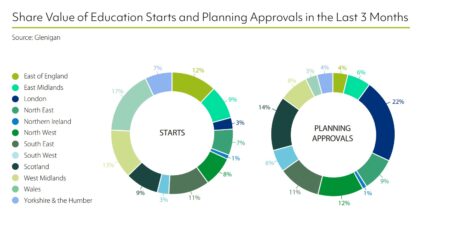

The report also looks at how activity is broken down by region, with Wales the most active for project starts in the three months to February, accounting for a 17% share of the sector to total £179m.

However, this is a 32% decrease on last year’s levels.

The West Midlands accounted for 13% of starts in the sector and fell 27% against the previous year to total £138m.

For detailed planning approvals, London was the most-active region, accounting for a 22% share, with the value having doubled on a year ago to total £279m.

Scotland also grew 174% in value against last year to total £174m, and the North East saw a 12% increase, totalling £114m.

The key players

The report provides information on the top contractors and clients within the sector.