Major boost for education construction sector

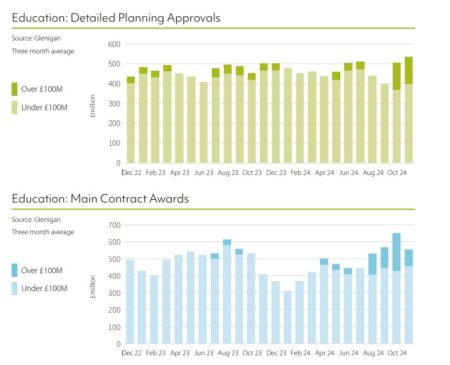

Education construction project starts, main contract awards, and detailed planning approvals all increased in the three months to November 2024 and compared to the previous year, according to The Glenigan’s December Construction Industry Review.

Major projects (worth £100m or more) starting during the period to the end of November totalled £675m, an increase from the preceding quarter, and a year ago when no major projects started on site.

Underlying education work starting on site (less than £100m in value) grew 31% compared with the preceding three months on a seasonally-adjusted (SA) basis and was 29% up on a year ago, totalling £1.5bn.

Education main contract awards also increased 5% compared with the preceding three months to total £1.6bn, with the value being 36% higher than the previous year.

And underlying contract awards increased 11% (SA) compared with the preceding three months and increased by 12% compared with the previous year.

Major projects totalled £300m, a 20% decrease compared with the preceding three months, but an increase compared with the previous year when there were no major projects.

Totalling £1.6bn, detailed planning approvals – often an indication of the pipeline moving forward – grew 22% compared with the preceding three months to stand 7% up on last year.

Major project approvals during the period totalled £410m, up on the previous quarter when no major projects were approved and 273% higher than last year.

Underlying project approvals fell 9% (SA) compared with the previous three months and decreased 14% compared with last year to total £1.2bn.

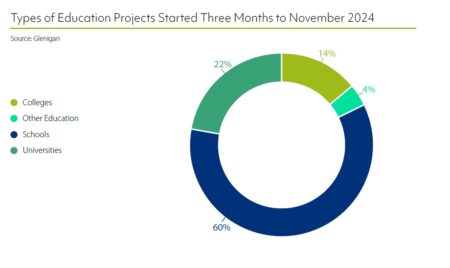

Types of projects

School project starts totalled £1.3bn during the three months to November and accounted for the largest share of education construction starts (60%), having doubled on the previous year.

Universities grew by 115% compared with last year to total £478m, accounting for 22% of the total value; while college starts also experienced a strong period, with the value having grown 26% compared with the previous year to total £302m, accounting for a 14% share of education sector work starting on site.

Regional variation

Scotland was one of the two most-active regions for education project starts during the three months to November, accounting for a 21% share of the sector to total £464m, having doubled on last year’s levels.

This growth was mainly thanks to the £300m Keystone Building in Glasgow.

Northern Ireland accounted for the same share of starts in the sector and jumped 60 times compared with the previous year to total £459m, boosted by the £375m Strule Shared Education Campus in Omagh.

Accounting for a 17% share, London grew 370% on a year ago to total £370m, while the East of England also experienced a strong period.

Starts in the region totalled £176m, having grown 16% on a year ago, standing for an 8% share of the sector.

Accounting for the same share at £172m, the South East experienced a 9% increase on a year ago while the South West and the West Midlands each accounted for 7%, having grown 298% and 93% to total £159m and £153m respectively.

Scotland was also the most-active region for detailed planning approvals in the education sector, accounting for a 23% share, with the value having increased 42% compared with a year ago to total £362m.

The North West grew 105% in value compared with last year to total £256m, accounting for a 16% share; and, accounting for an 8% share, Northern Ireland jumped nearly tenfold compared with 2023 figures to total £135m.

In contrast, adding up to £177m, the South East fell 14% compared with last year, accounting for 11% of education consents.

And, at £163m, Wales experienced a 40% decline, accounting for 10% of consents.

Accounting for a 7% share, approvals in London totalled £114m, 5% down on a year ago.

Leading players

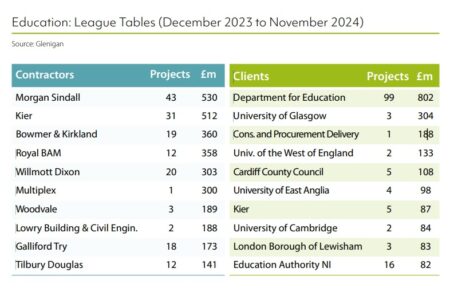

The report also provides details of the leading contractors and clients within the sector.

Morgan Sindall, Kier, and Bowmer & Kirkland were the leading contractors, with 93 projects between them worth over £1.4bn.

The Department for Education tops the client table, with 99 projects worth £802m.

The University of Glasgow and Cons. and Procurement Delivery were second with four projects between them worth £304m and £188m respectively.